Remittances to Georgia Have Fallen but Some Countries Are Seeing a Rise

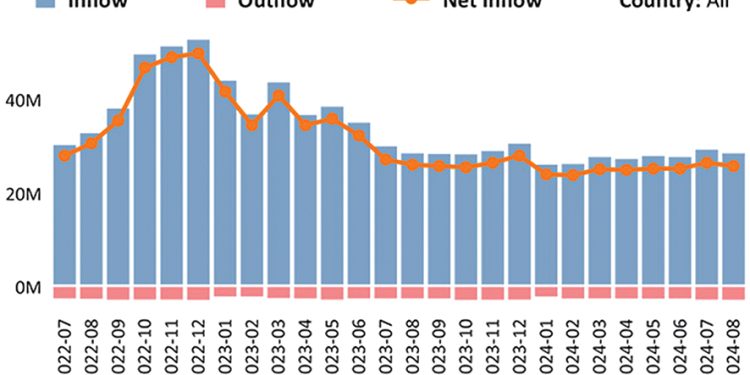

Georgia’s National Bank numbers for July show that remittances have dropped by 1.3% compared to last year, reaching $283 million. The decline is mainly due to a drop in transfers from Russia, Ukraine, and Belarus. However, there’s a new trend: more Georgians are leaving the country for high-wage jobs abroad.

The US is now the largest contributor of remittances, with a 16.9% increase compared to last year. Italy also saw a rise, with a 6.6% increase in remittances. Other countries where remittances increased include Germany (18%), Greece (6%), and Israel (7%).

The increase in remittances reflects the growing number of Georgians who are leaving the country to work abroad. According to a survey by the Caucasus Barometer, over half of Georgians have relatives living abroad.

Georgia’s population is shrinking, with nearly a quarter of Georgians having moved abroad since 2010. The country’s dependence on remittances has increased noticeably, from 11% to 16% of GDP between 2013 and 2022.

Remittances are crucial for many Georgian families, allowing them to save money, buy property, and stabilize their finances. However, the majority of these funds are spent on basic needs such as food, utility bills, and clothing, with only a small portion being saved or invested.

A recent EU study on Georgian labor migrant women highlighted the importance of remittances in supporting families but also noted that the sustainability of this impact on the economy is questionable. The study suggested that the majority of remittances are spent on basic needs rather than savings or investments.

The report emphasized the need to support female migrants returning to Georgia, citing a cycle of migration where women often leave their children behind and struggle with emotional and social difficulties upon return.

Remittances have become a vital source of income for many Georgian families. While they may not address underlying economic issues such as low wages and unemployment, they do provide a safety net that allows families to meet their basic needs and possibly invest in the future.