Bloomberg reports that Russia has defaulted for the first time since a century on its foreign currency sovereign debt. This is the culmination of Western sanctions which have become increasingly stricter and have shut down payment routes with overseas creditors.

“For months the country found ways around the penalties imposed following the Kremlin invasion of Ukraine. The grace period for about $100 million in snared interest due on May 27 expired at the end the day on Sunday. This deadline is considered a default event if it is missed.

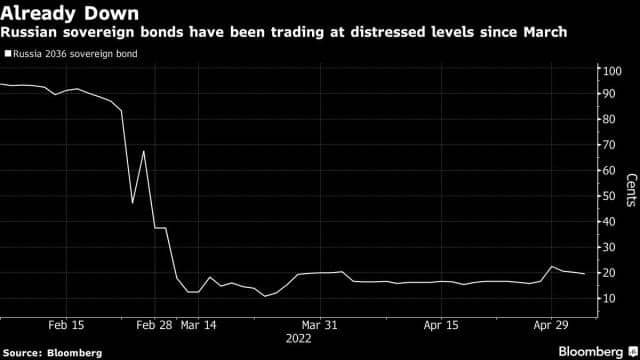

“It’s an ominous sign of the country’s rapid transformation from a thriving economy to a financial and political outcast. Since the beginning of March, the nation’s eurobonds are trading at distressed levels, the central bank has frozen its foreign reserves, and the largest banks have been cut off from the global financial systems.

“But given the damage done to the economy and market, the default is mostly symbolic for the moment and matters little to Russians who are dealing with double-digit rates of inflation and the worst economic contraction since years.

“Russia has resisted the default designation. It says it has the funds to pay any bills, and was forced into non-payment. It announced last week, as it tried to find a way out, that it would service its $40 billion in outstanding sovereign debts in rubles. It criticized a “force majeure” situation, which it said was artificially created by the West, according to the article.

Hassan Malik is a senior sovereign analyst with Loomis Sayles & Company LP. He said, “It’s a rare thing when a government, which otherwise has the resources, is forced into default by an external government.” “It will be one of the biggest defaults in history.”

Source: Bloomberg

Read More @ georgiatoday.ge