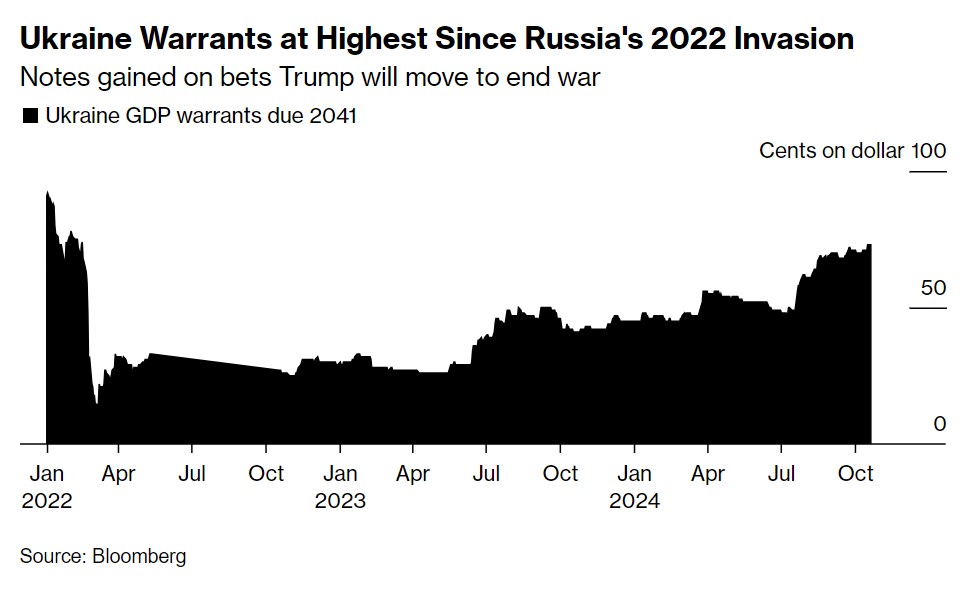

These levels were last seen just before Russia’s full scale invasion in early 2022.

Bloomberg reports that Ukraine’s dollar-bonds surged amid expectations that the newly reelected US President Donald Trump would end the war against Russia.

Trump has repeatedly claimed that he can broker peace between Moscow, Kyiv and the Ukrainian leadership within 24 hours after taking office. He argues that his personal relationship with Russian President Vladimir Putin as well as Ukraine’s leaders will help him secure a deal.

Ukraine’s GDP warrants – debt securities linked to economic development – traded at 74 cents per dollar – levels not seen since Russia’s invasion in 2022. Fund managers increased their holdings in Ukraine’s dollar bonds as Trump’s victory became increasingly likely.

Ukraine’s 1.75% note due in 2035 has jumped 1.8 cents, to 47.3 cents per dollar. Leading emerging market gains.

“Bonds are based on the likelihood that the war will end sooner than expected, rather than the shape of the deal,” said Thys Louis, portfolio manager at Ninety One UK Ltd.

The Ukrainian bond rally contrasted sharply with the broader emerging market currencies and stocks, which declined due to expectations of new trade tariffs. Eastern European currencies were especially affected, with the Hungarian Forint falling to its lowest level since late 2012.

Peace negotiations face significant challenges. The prospect of finding a common ground is still far away. While Ukrainian President Volodymyr Zelenskyy insists on fighting, Ukraine’s army heavily relies on US aid.

Zelenskyy stated today that Trump’s approach of “peace through force” could help end this conflict. He added that Ukraine continues to depend on the United States “strong bipartisan backing.”

Read More @ euromaidanpress.com